Decentralized Finance (DeFi) is most trending in the crypto world. Along with DeFi, yEarn.Finance also ranks to be one of the hottest DeFi players. yEarn.Finance provides automated yield farming strategies to liquidity providers and yield farmers. yEarn uses various DeFi lending platforms like Aave, Compound, dYdX, and Fulcrum to provide yield farming.

Yield Farming is a popular method where the cryptocurrency owners lend their assets to generate higher returns. yEarn allows users to use multiple DeFi platforms simultaneously to generate the highest yield possible. For most of the investors, yEarn is one of the largest sources of passive income. According to DeFi Pulse, yearn.finance has $166.8 million assets locked up.

YFI Token

Andre Cronje is the mastermind behind yEarn, which was previously called iEarn. The yEarn project introduced its governance token called the $YFI token last month. The YFI token has no intrinsic value, as the founder states that

“WE HAVE RELEASED YFI, A COMPLETELY VALUELESS 0 SUPPLY TOKEN. WE RE-ITERATE, IT HAS 0 FINANCIAL VALUE”.

The YFI token follows the “Governance” model. This means that the value of the token comes from voting on where the protocol will go next.

YFII

The initiator, Andre Cronje, had no intension to participate in the governance. So, he wished the community to be autonomously organized. Hence, the mining/farming of YFI token has stopped on July 26. As mining is stopped, there are chances that there may be a sharp drop in the liquidity of the pools.

To prevent this drop in the liquidity of the pools, the community proposed a YIP-8 model, where token emissions are halved every week. But, YIP-8 was rejected. Hence, to protect Andre’s design from being spoilt by whales, YFI was forked to YFII. Similar to the YFI token, YFII token also acts as a governance token to the community.

Various exchanges like Uniswap, Balancer, 1inch, Hoo.com, Vines, LBank, & BKEX have listed YFII. Although the token is new, many exchanges have listed it providing various options for the users to trade the token.

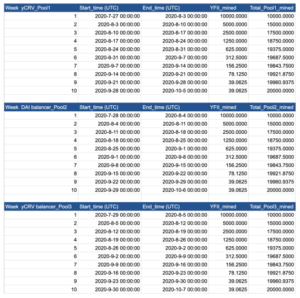

The total supply of YFII was 60,000 tokens earlier, but, now 20,000 tokens are burned, so now the total supply is 40,000 tokens. YFII is designed to have three different pools, where each pool will be emitting 20,000 tokens to yield farmers. Initially, they start with 10,000 tokens in the first week, halving every 7 days. The following image shows the distribution of YFII in 10 weeks.

How to farm YFII token?

YFII mining/farming can be done in three different methods which give different yields and are associated with some risks. The methods are as follows:

Pool 1: This method uses yCurve tokens.

- The user logs into https://www.curve.fi/iearn/

- There is a deposit page, where the user deposits either USDT, USDC, TUSD or DAI.

- Then, the yCurve tokens are generated.

- The user will then stake yCurve tokens on https://yfii.finance/#/ in the yEarn pool.

- The risk in this method is that it uses stable coins and invests them automatically into different protocols. In case of any vulnerabilities in the protocols, it may result in the theft of funds.

Pool 2: Pool 2 uses Balancer’s 98% DAI: 2% YFII liquidity pool.

- YFII or DAI tokens are staked in this pool which is https://pools.balancer.exchange/#/pool/0x16cAC1403377978644e78769Daa49d8f6B6CF565

- The BPT tokens are created.

- The user will then stake the BPT tokens on https://yfii.finance/#/ in the Balancer Pool.

- The risk is that if the YFII tokens are sold in large amounts, then DAI tokens will be used to by YFII. This may result in the drop of YFII token price which may further lead to a reduction of pooled assets.

Pool 3: This method involves staking of YFII in the governance pool. Once the staking is completed successfully, the user should see an increase in “rewards available” with the addition of YFII tokens. The user can claim the tokens anytime with the use of “claim rewards”.

How to buy YFII?

There are a few options where the user can buy YFII:

- Uniswap (YFII/ETH pool and YFII/USDT pool)

- Balancer (YFII/DAI pool)

- 1inch

Among these options, Uniswap pool of YFII/ETH holds the best liquidity and pricing. While 1inch has not yet natively integrated YFII.

Buying on Uniswap (YFII/ETH and YFII/USDT)

For buying YFII token on the Uniswap Exchange, the user has to follow the below steps:

- The user should visit https://app.uniswap.org/#/swap

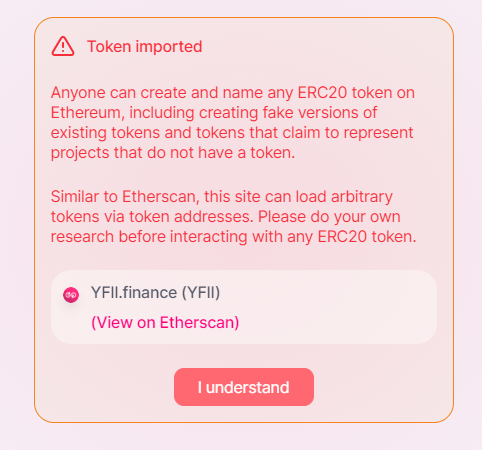

- On visiting the page, the user will find an “I understand” option which is to be clicked after reviewing the message. Also, there is a “View on Etherscan” option available on the screen. On clicking this “View on Etherscan” button, the user will be directed to another page where the contract address of the YFII.finance is available. By clicking the “I understand” option, the contract address of the user will be verified.

- After the verification of the contract address, the user can swap their ETH with the desired amount of YFII token.

- The confirmation of the swap comes from the user’s wallet.

- The user should copy the contract address and paste it on their wallet to begin the addition of tokens to the wallet.

Buying on Balancer (YFII/DAI)

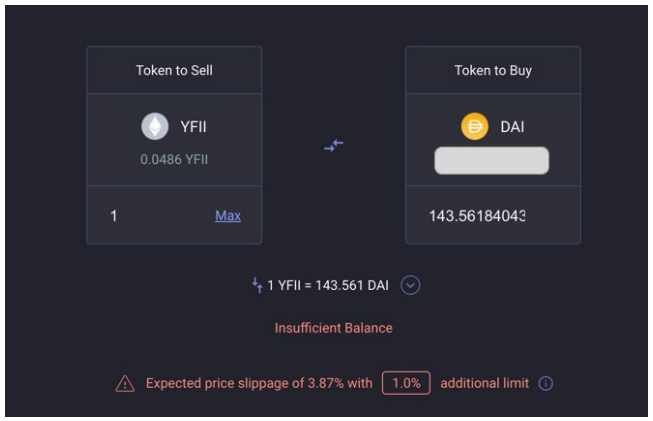

- If the user wants to buy YFII on Balancer, then he/she should visit https://balancer.exchange/#/swap.

- After visiting the page, the user should choose DAI on one side and choose YFII on the other side.

- The user should consistently keep an eye on the price fluctuations to trade effectively.

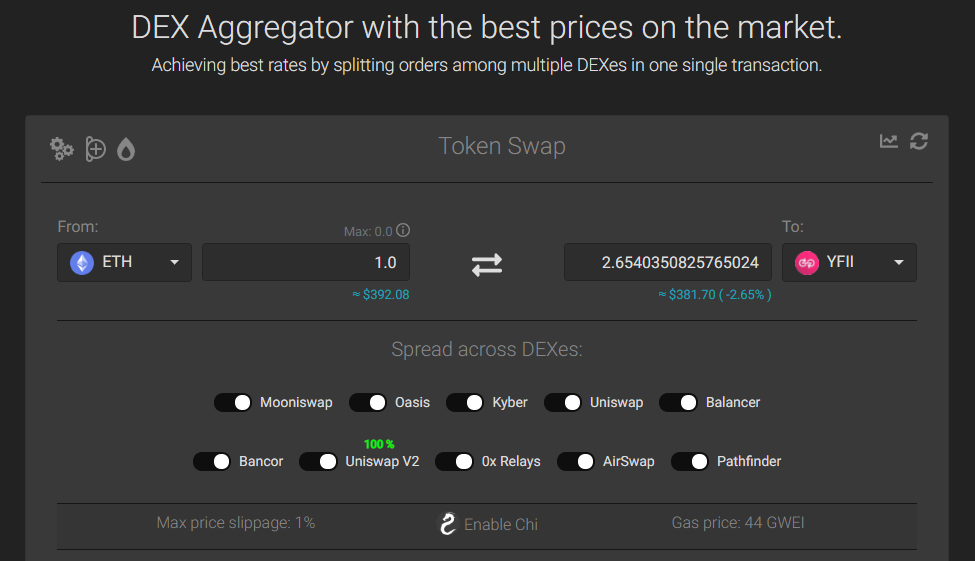

Buying on 1inch

1inch exchange also allows the user to swap their Ethereum with YFII tokens. Similar to the previous exchanges, the user should enter ETH on one side and YFII on another side to buy the YFII tokens.

Price Analysis

At the time of writing, YFII finance price is $144.20 and has a market cap of $3,164,235. YFII token came into existence on 29 July 2020, with a price of $460.74. The token saw its highest value on 31 July 2020 at a price of $1,124.41. After which it reduced to its lowest i.e. $100.57 on 03 August 2020. From then on the token is fluctuating in the range of $100-$200.

Final Word

YFII is too volatile in nature. YFII token is still in Beta version and the smart contract is not been audited yet. So, if an investor wants to invest in this token, then he/she should thoroughly go through the financial analysis before investing. Also, the investor should invest only that much amount which he/she is ready to lose.

… [Trackback]

[…] Read More on that Topic: coingyaan.com/yfii-finance-an-innovative-decentralized-defi-mining-pool/ […]

… [Trackback]

[…] Find More Information here to that Topic: coingyaan.com/yfii-finance-an-innovative-decentralized-defi-mining-pool/ […]

… [Trackback]

[…] There you will find 95353 additional Information to that Topic: coingyaan.com/yfii-finance-an-innovative-decentralized-defi-mining-pool/ […]