DeFi investments are towering which has resulted in high returns for some, and high losses for some, amid the rumors of scams. One such trending scam is the SushiSwap scam of the $SUSHI protocol that promised the incredible upper side to its participants.

SUSHI is a fork of Uniswap. It was created by “Chef Nomi” and has been handed over to FTX CEO Sam Bankman-Fried (SBF) on Sep.6. This decision was taken after SushiSwap fell from $9.5 to $1.13 in just five days.

The project was handed over to SBF after Nomi swapped 2,558,644 SUSHI from the dev funds with 20,039 ETH. This capital had to be used to finance the development of the SUSHI project.

The head of DTCC Capital, Spencer Noon, was the first one to spot Nomi’s sell-off of SUSHI tokens. He said:

“Anonymous founder of SushiSwap sells all of his Sushi. WHO COULD HAVE POSSIBLY PREDICTED THIS?!”

BREAKING 🚨

Anonymous founder of @SushiSwap sells all of his $SUSHI 🍣

WHO COULD HAVE POSSIBLY PREDICTED THIS?! https://t.co/DtZoqQhUUt pic.twitter.com/cEje9335fZ

— Spencer Noon (@spencernoon) September 5, 2020

Addressing the outrage, Nomi said he did not “exit scam”. He said he deserved the funds because he created the project. He claimed that,

And that is what I do. I created idea. I created community. I did it best when I don't have price under pressure. And if you believe in the community. You believe in the idea. You stay. If not, you are free to leave. It is an open experiment. No strings attached.

— Chef Nomi #SushiSwap (@NomiChef) September 5, 2020

The prominent developer of Yearn.Finance, Andre Cronje, asked Nomi to return all the funds if he is leaving the project,

What do you mean "without me"? Are you leaving the project? If so, are you giving the dev funds back? All you did so far was hand over a token that was built off of @UniswapProtocol.

Weren't the funds meant to further develop? Aren't you that developer?

— Andre Cronje (@AndreCronjeTech) September 6, 2020

SUSHI continued to drop, SBF handled the protocol and the community reacted positively. SBF claimed that the keys of SUSHI will be transferred to a multi-sig, which will become decentralized. Although SBF criticized the actions of Chef Nomi, he claimed that if Nomi would not drop out, Sushi would have collapsed. SBF summarized as:

16) TL;DR:

a) Nomi sucks and hurt the community

b) Sushi shows promise as a dynamic AMM built by the community

c) If Nomi doesn't step down, it's over for Sushi.

d) If Sushi adds a division on Serum, we'll give 5mm SUSHI to farmers

e) Either way, AMMs coming to Serum

— SBF (@SBF_Alameda) September 6, 2020

Band Protocol CTO Involvement in SushiSwap

It was claimed that Band Protocol CTO, Sorawit Suriyakarn, was Nomi Chef. Sorawit replied to this allegation saying that he is not the one.

Let’s clear the air: I am not Nomi Chef. It is shocking and amusing that people have made these claims. This is nothing more than a personal attack on me and a strike at Band.

— Sorawit Suriyakarn | BAND 🅑 🚫🐻 (@nomorebear) September 6, 2020

But, then it comes to light that he was involved in the review of the project code. A medium post reveals the same.

“Sorawit Suriyakarn as CTO, often reviews the code for other projects, as it is commonplace within the industry. He did a review of the initial code deployment of SushiSwap to make sure it was safe for public use.

We value our partnerships and want to assure our investors, partners, and community that our initial interest in Sushiswap was straight forward — if it became successful, Band token, as a ‘farmable’ asset, would gain more visibility and therefore would boost its usage.”

Binance launched the BAND token through its IEO platform in 2019. Then, later Binance partnered with Band protocol to integrate its oracle data and came under fire after listing SUSHI.

Must Read: Top 5 Low Market Cap DeFi Tokens

SUSHI was listed on Binance

The SUSHI token was listed on Binance Exchange on September 1. The reports claim that the DeFi liquidity provision platform managed to have funds worth $1.2 billion under lock. Even then the SUSHI price began to drop. Eventually, it resulted in the SushiSwap.

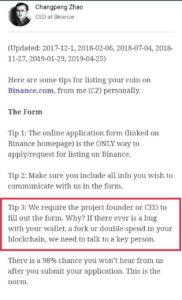

After this, people started posting screenshots of the tips on listing a coin on the Binance Exchange. In the tips, CZ had mentioned that Binance will not list a coin unless the founder or CEO of the token or coin is known. But in the case of SUSHI token, the founder anonymous.

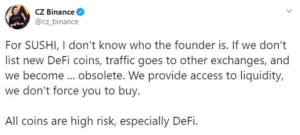

So, many traders on Twitter went nuts on CZ Binance to which CZ responded as:

Hence, it will be too early to come to any conclusions about whether this incident is an exit scam or something else. The crypto world is full of good and bad surprises.

… [Trackback]

[…] Here you can find 3911 additional Information on that Topic: coingyaan.com/is-binance-cz-involved-in-the-sushiswap-scam/ […]

… [Trackback]

[…] Read More to that Topic: coingyaan.com/is-binance-cz-involved-in-the-sushiswap-scam/ […]

… [Trackback]

[…] Read More on that Topic: coingyaan.com/is-binance-cz-involved-in-the-sushiswap-scam/ […]

… [Trackback]

[…] There you will find 54062 more Information on that Topic: coingyaan.com/is-binance-cz-involved-in-the-sushiswap-scam/ […]